Recent market declines don't have to be all bad news for investors: They may provide you an opportunity to cut your taxes in retirement.

The Dow Jones Industrial Average swooned on Monday, plummeting by nearly 500 points that morning and then rallying in the afternoon to close 34.31 points higher at 24,423.26.

In all, market volatility has been the norm since October.

However, there may be an upside to the mayhem in the form of a tax-savings strategy. If your traditional individual retirement account has declined in value due to stock market fluctuations, it might be time to consider converting to a Roth IRA.

With a Roth conversion, you pay income taxes in the present on the amount converted from the traditional IRA, but you benefit from future tax-free growth and withdrawals in retirement.

"If the market is tanking and you think it's going to go back up, right now is the time to do it," said Ed Slott, CPA and founder of Ed Slott and Co. "You have low tax rates and lower values."

Here's who might benefit from a Roth conversion amid a falling market.

Upside of downturns Sam Edwards | Getty Images

Sam Edwards | Getty Images There are two factors that might make a Roth conversion a good deal in the near term.

First, there are the declining share values. This means you can transfer a greater portion of your IRA portfolio — more shares — to the Roth for potential tax free growth and withdrawals in retirement.

"Let's say we were going to convert $50,000, now we can do it with a greater number of shares," said David Oransky, a CPA and member of the American Institute of CPAs' Personal Financial Planning Executive Committee.

"This is the CPA getting excited about the market dip," he said.

Sign Up for Our Newsletter Your Wealth Weekly advice on managing your money SIGN UP NOW Get this delivered to your inbox, and more info about about our products and services.By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy. .investigation-wrapper .description{ text-align:center; padding-bottom:15px; } .nl-privacy{ font-size: 10px; padding-top: 20px; display:block; } .wildcard .investigation-wrapper { -webkit-box-shadow: 0px 0px 4px 0px #999999; /* Android 2.3+, iOS 4.0.2-4.2, Safari 3-4 */ box-shadow: 5px 5px 5px 0px #999989; } .subsection .investigation{ background: #efefef; border-radius: 3px; padding: 10px 20px 20px 20px; } .investigation small{white-space:normal;} .subsection .investigation h1{ text-transform: uppercase; text-align: center; font-family: "Gotham Narrow Ssm 5r"; margin-bottom: 0px; padding-bottom:0px; font-size: 18px; margin-top: 10px; word-spacing: 1.5px; color: #333333; } .subsection .investigation .headline_title { font-size: 28px; padding-top: 20px; display: block; font-family: "Gotham Narrow Ssm 7r"; padding-bottom:5px; } .subsection .email-info { background: rgba(74, 144, 226, 1); max-width: 140px; margin: 0px auto; text-align: center; padding: 6px 1px; color: #fff; border-radius: 5px; } .subsection .email-info { color:#fff; } .subsection .email-info:hover{ background: #2077B6; } body .subsection.investigation-wrapper{overflow:visible;}

Second, there are the lower income tax rates that are now in effect due to the Tax Cuts and Jobs Act.

This tax overhaul trimmed the individual income tax rates, so if you're converting in 2018, you're likely paying a lower income tax rate than you would have in previous years.

See below for next year's brackets.

#dw-chart{width: 100%;height: 500px;border: none;padding-top: 32px;box-sizing: border-box;-moz-box-sizing: border-box;-webkit-box-sizing: border-box;} No Roth do-oversBefore you break out the bubbly, know that this strategy isn't necessarily for everyone.

For instance, prior to the tax overhaul, financial planners and CPAs used to recommend Roth conversions early in the year. Investors would then see how their Roth accounts performed over subsequent months.

If any of the converted accounts didn't perform well, they might undo — or recharacterize — the transaction.

The Tax Cuts and Jobs Act took that tool away, so any Roth conversions you do now are permanent.

It's something to bear in mind in the event you convert some of your savings now and the market tanks in 2019.

"You can't play both ends like you used to do," Slott said. "There are no do-overs anymore."

Income hurdles Paul Viant | Getty Images

Paul Viant | Getty Images Perhaps the best contenders for a Roth conversion might be young retirees who have deferred on Social Security but haven't yet reached 70½ — the age at which they must begin taking required minimum distributions from their traditional IRA and 401(k) plans, Oransky said.

"These are gap years in which they will be in the lowest tax brackets," he said.

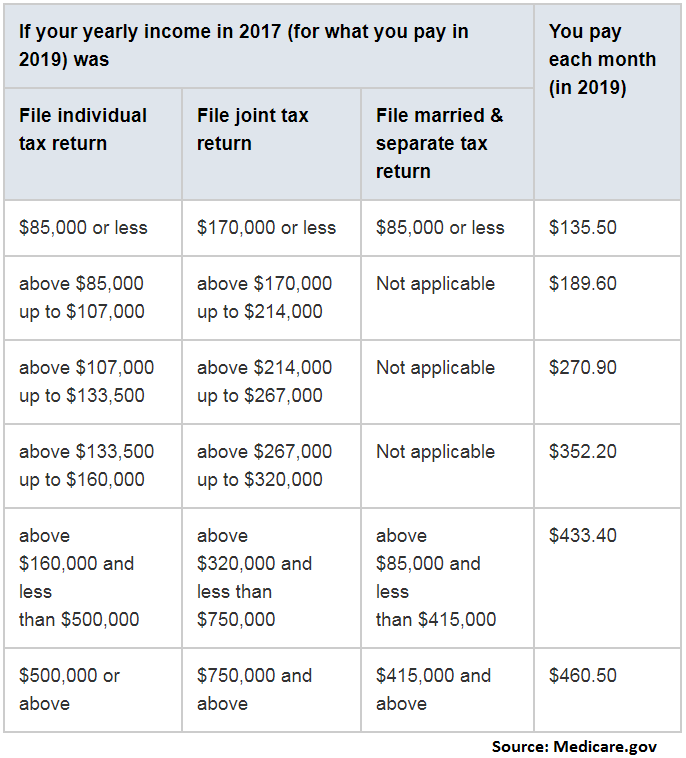

Retirees should also make sure that the conversion amount doesn't inadvertently raise their Medicare Part B (medical insurance) and Part D (prescription drug) premiums in future years.

That's because the amount you pay for these premiums in a given year is based on your modified adjusted gross income from two years prior.

See below for details on Medicare Part B premiums in 2019, which will be based on MAGI for 2017.

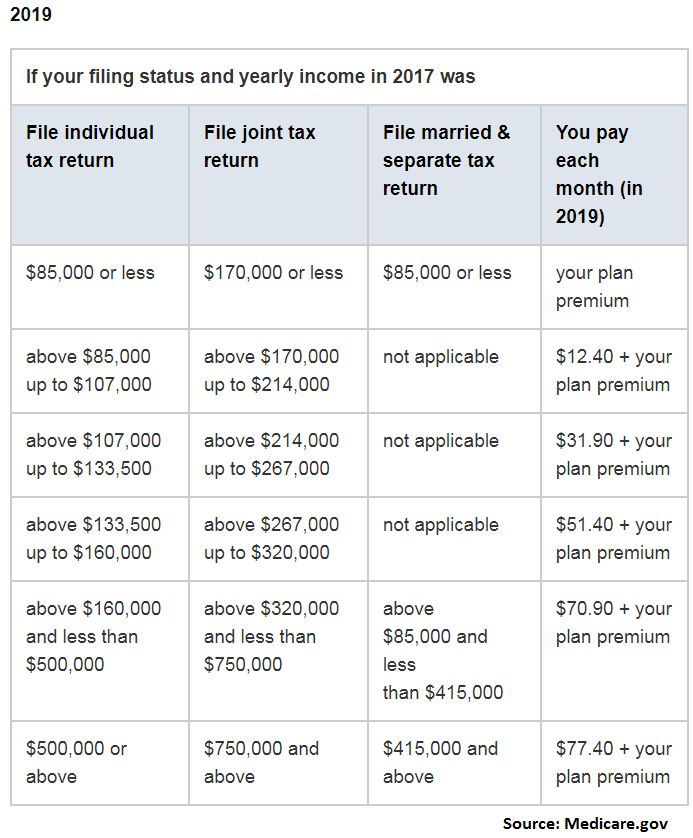

Here are the premiums for Medicare Part D premiums in 2019.

Finally, be sure that you have the money available to pay the taxes owed on the conversion. Ideally, this should be money that you have in a taxable account or someplace other than the amount you're converting.

"If you pay the taxes out of the conversion, it reduces the efficacy," said Oransky. "The full amount should go into the Roth IRA."

More from Fixed Income Strategies

How to play rising bond rates without losing your shirt

Why investors near retirement should fear the big yield curve inversion

Many Americans dream of retirement but lack a real game plan

No comments:

Post a Comment