Automakers are looking to China's biggest auto show this year to help boost sales in this huge but cooling market. Total sales last year reached 17.9 million vehicles, but growth is expected to slow from 15.7% to as low as 8%, even as newcomers including Lincoln and Tesla enter the market.

The new Escort, a compact sedan with a 1.4-liter, four-cylinder engine, was designed at Ford's development center in China with features to appeal to local tastes. They include a bigger back seat for children and grandparents, lighter colors and cup holders made to fit iced tea bottles.

The Escort goes on sale in China this year, expanding later to other markets, said CEO Alan Mulally.

Best Construction Material Stocks To Watch Right Now: AEP Industries Inc.(AEPI)

AEP Industries Inc. engages in the production, manufacture, and distribution of plastic packaging products in the United States and Canada. The company offers a line of polyethylene, polyvinyl chloride, and polypropylene flexible packaging products for consumer, industrial, and agricultural applications. Its products include custom films for industrial applications, including sheeting, tubing, and bags; films that protect items stored outdoors or in transit, such as boats and cars; a range of shrink films, barrier films, and overwrap films; stretch film products for hand wrap and rotary applications; and pre stretch and high performance products for commodity and specialty uses. The company also provides food wraps products, including blown plastic film fold-top bags, twist-tie bags, and food containers under the Seal Wrap brand for the supermarket and industrial markets; a range of coextruded polyolefin films and monolayer films for food, pharmaceutical, and medical appli cations; and canliners product line comprising trash bags and institutional bags. In addition, it offers printed rollstock to the food and beverage industries, and manufacturing and distributing companies; and unplasticized polyvinyl chloride films for use in battery labels, twist films, and credit card laminates; and various film products with agricultural applications, such as silage, smooth mulch films, and fumigation films. Further, the company provides disposable consumer and institutional plastic products, which include table covers and skirts, aisle runners, aprons, bibs, gloves, boots, freezer/storage bags, saddle pack bags, locker wrap and custom imprint designs for the food service, party supply, and school/collegiate markets under the Sta-Dri brand. AEP Industries Inc. markets its products directly to end-users, as well as through distributors. The company was founded in 1970 and is based in South Hackensack, New Jersey.

Advisors' Opinion:- [By Lisa Levin]

AEP Industries (NASDAQ: AEPI) shares touched a new 52-week low of $34.20. AEP shares have dropped 56.11% over the past 52 weeks, while the S&P 500 index has gained 15.91% in the same period.

5 Best Dow Dividend Stocks To Invest In 2014: Con-way Inc (CNW)

Con-way Inc. (Con-way), incorporated in 1958, provides transportation, logistics and supply-chain management services for a wide range of manufacturing, industrial and retail customers. Con-way�� business units operate in regional and transcontinental less-than-truckload and full-truckload freight transportation, contract logistics and supply-chain management, multimodal freight brokerage, and trailer manufacturing. Con-way is divided into four segments: Freight, Logistics, Truckload, and Other. At December 31, 2011, Con-way Freight operated 286 freight service centers, of which 144 were owned and 142 were leased. At December 31, 2011, Con-way Freight owned and operated approximately 9,200 tractors and 26,400 trailers, including tractors held under capital lease agreements.

Freight

The Freight segment consists of the operating results of the Con-way Freight business unit. Con-way Freight is a less-than-truckload (LTL) motor carrier that utilizes a network of freight service centers to provide day-definite regional, inter-regional and transcontinental less-than-truckload freight services throughout North America. LTL carriers transport shipments from multiple shippers utilizing a network of freight service centers combined with a fleet of line-haul and pickup-and-delivery tractors and trailers. Freight is picked up from customers and consolidated for shipment at the originating service center. Freight is consolidated for transportation to the destination service centers or freight assembly centers. At Freight assembly centers, freight from various service centers can be reconsolidated for transportation to other freight assembly centers or destination service centers. From the destination service center, the freight is delivered to the customer. Typically, LTL shipments weigh between 100 and 15,000 pounds. In 2011, Con-way Freight�� average weight per shipment was 1,305 pounds.

Logistics

The Logistics segment consists of the operating results o! f the Menlo Worldwide Logistics business unit. Menlo Worldwide Logistics develops contract-logistics solutions, which can include managing complex distribution networks, and providing supply-chain engineering and consulting, and multimodal freight brokerage services. Menlo Worldwide Logistics��supply-chain management offerings are primarily related to transportation-management and contract-warehousing services. Transportation management refers to the management of asset-based carriers and third-party transportation providers for customers��inbound and outbound supply-chain needs through the use of logistics management systems to consolidate, book and track shipments. Contract warehousing refers to the optimization and operation of warehouses for customers using technology and warehouse-management systems to reduce inventory carrying costs and supply-chain cycle times. For several customers, contract-warehousing operations include light assembly or kitting operations.

Menlo Worldwide Logistics provides its services using a customer- or project-based approach when the supply-chain solution requires customer-specific transportation management, single-client warehouses, and/or single-customer technological solutions. However, Menlo Worldwide Logistics also utilizes a shared-resource, process-based approach that leverages a centralized transportation-management group, multi-client warehouses and technology to provide scalable solutions to multiple customers. Additionally, Menlo Worldwide Logistics segments its business based on customer type. At December 31, 2011, Menlo Worldwide Logistics operated 76 warehouses in North America, of which 55 were leased by Menlo Worldwide Logistics and 21 were leased or owned by clients of Menlo Worldwide Logistics. Outside of North America, Menlo Worldwide Logistics operated an additional 63 warehouses, of which 48 were leased by Menlo Worldwide Logistics and 15 were leased or owned by clients. Menlo Worldwide Logistics owns and operates a small fleet of tr! actors an! d trailers to support its operations, but primarily utilizes third-party transportation providers for the movement of customer shipments.

Truckload

The Truckload segment consists of the operating results of the Con-way Truckload business unit. Con-way Truckload is a full-truckload motor carrier that utilizes a fleet of tractors and trailers to provide short- and long-haul, asset-based transportation services throughout North America. Con-way Truckload provides dry-van transportation services to manufacturing, industrial and retail customers while using single drivers as well as two-person driver teams over long-haul routes, with each trailer containing only one customer�� goods. This origin-to-destination freight movement limits intermediate handling and is not dependent on the same network of locations utilized by LTL carriers. On average, Con-way Truckload transports shipments more than 800 miles from origin to destination. Under its regional service offering, Con-way Truckload transports truckload shipments of less than 600 miles, including local-area service for truckload shipments of less than 100 miles.

Con-way Truckload offers through-trailer service into and out of Mexico through all major gateways in Texas, Arizona and California. For a shipment with an origin or destination in Mexico, Con-way Truckload provides transportation for the domestic portion of the freight move, and a Mexican carrier provides the pick-up, linehaul and delivery services within Mexico. At December 31, 2011, Con-way Truckload operated five owned terminals with bulk fuel, tractor and trailer parking, and in some cases, equipment maintenance and washing facilities. In addition, Con-way Truckload also utilizes various drop yards for temporary trailer storage throughout the United States. At December 31, 2011, Con-way Truckload owned and operated approximately 2,700 tractors and 8,000 trailers, including tractors held under capital lease agreements.

Other

! The Other! reporting segment consists of the operating results of Road Systems, a trailer manufacturer, and certain corporate activities for which the related income or expense has not been allocated to other reporting segments, including results related to corporate re-insurance activities and corporate properties. Road Systems primarily manufactures and refurbishes trailers for Con-way Freight and Con-way Truckload.

Advisors' Opinion:- [By Rich Smith]

Consider: According to YRC, the $150.9 million it currently pays in annual interest exceeds the $92.6 million in interest obligations paid by "all [of its] competitors combined." Con-Way (NYSE: CNW ) , for example, sports a debt load about half of YRC's, yet pays only about one-third �as much in interest on that debt. Old Dominion Freight (NASDAQ: ODFL ) has 12% the debt �of YRC, but only 7% of the interest expense.

- [By Ben Levisohn]

Shares of Heartland Express have gained 50% this year, trumping the 38% rise in Con-Way (CNW) and the 29% advance in J.B. Hunt Transport Services (JBHT) but lagging Old Dominion Freight Lines (ODFL) and Swift Transportation (SWFT).

- [By Ben Levisohn]

Shares of Atlas Air have plunged 15% to $37.13 today at 1:48 p.m., on what has been a lousy day for shippers and those involved with shipping. Trucking company Con-Way (CNW) has fallen 2.5% to $40.38 after it said earnings would be unchanged from a year ago, well short of analyst forecasts. FedEx (FDX) has dropped 0.7% following UPS’s miss.

5 Best Dow Dividend Stocks To Invest In 2014: Euronet Worldwide Inc.(EEFT)

Euronet Worldwide, Inc. provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers. The company operates in three segments: EFT Processing, epay, and Money Transfer. The EFT Processing segment provides electronic payment solutions consisting of automated teller machine (ATM) network participation, outsourced ATM and point-of-sale (POS) management solutions, credit and debit card outsourcing, card issuing, and merchant acquiring services; advertising, customer relationship management, currency conversion, mobile top-up, bill payment, fraud management, and foreign remittance payout services; and integrated software solutions for electronic payments and transaction delivery systems. As of December 31, 2011, it processed transactions for a network of 14,224 ATMs and approximately 57,000 POS terminals in Europe, the Middle East, and the Asia Pacific. The epay segment engages in the ele ctronic distribution of prepaid mobile airtime and other electronic payment products, and provides collection services for various payment products, cards, and services. This segment operates a network of approximately 615,000 POS terminals to enable electronic processing of prepaid mobile airtime top-up services and other electronic payment products in Europe, the Middle East, the Asia Pacific, North America, and South America, as well as distributes vouchers and physical gifts in Europe. The Money Transfer segment provides consumer-to-consumer money transfer services through a network of sending agents and company-owned stores in North America and Europe; customers bill payment services; payment alternatives, such as money orders and prepaid debit cards; check cashing services for various issued checks; and foreign currency exchange services. The company serves customers in approximately 150 countries worldwide. Euronet Worldwide, Inc. was founded in 1994 and is headquarte red in Leawood, Kansas.

Advisors' Opinion:- [By John Udovich]

Small cap money transfer stock Euronet Worldwide, Inc (NASDAQ: EEFT) and Wal-Mart Stores, Inc (NYSE: WMT) have announced an exclusive money transfer service called "Walmart-2-Walmart,��meaning its time to take a closer look at the stock along with the performance of peers like Moneygram International Inc (NASDAQ: MGI), Xoom Corp (NASDAQ: XOOM) and The Western Union Company (NYSE: WU) which fell 17.68%, 4.32% and 4.98%, respectively.

5 Best Dow Dividend Stocks To Invest In 2014: Qualys Inc (QLYS)

Qualys, Inc. (Qualys), incorporated on December 30, 1999, is a provider of clouds security and compliance solutions that enable organizations to identify security risks to their information technology (IT) infrastructures, help protect their IT systems and applications from cyber attacks and achieve compliance with internal policies and external regulations. The Company designed its QualysGuard Cloud Platform to transform the way organizations secure and protect their IT infrastructures and applications. The Company's cloud platform offers an integrated suite of solutions that automates the lifecycle of asset discovery, security assessments, and compliance management for an organization's IT infrastructure and assets, whether they reside inside the organization, on their network perimeter or in the cloud.

The Company provides its solutions through a software-as-a-service model, primarily with renewable annual subscriptions. These subscriptions require customers to pay a fee in order to access the Company's cloud solutions. The Company's QualysGuard Cloud Platform consists of a suite of IT security and compliance solutions that leverage the Company's shared and extensible core services and its scalable multi-tenant cloud infrastructure. The Company's suite of solutions provides security intelligence by automating the life cycle of IT asset discovery, security assessment and compliance management. The Company's cloud platform's infrastructure includes integrated services that deliver a automated and scalable scanning infrastructure capable of scanning IT systems and Web applications, inside and outside corporate firewalls. The Company also provides open application program interfaces (APIs), and other developer tools that allow third parties to embed its technology into their solutions and build applications on its cloud platform.

The Company's suite of solutions, which the Company refers to as the QualysGuard Cloud Suite, includes Vulnerability Management, Web Application Sca! nning, Malware Detection Service, Policy Compliance, PCI Compliance and Qualys SECURE Seal. The Company's customers can subscribe to one or more of the Company's security and compliance solutions based on their initial needs and expand their subscriptions over time to new areas within their organization or to additional QualysGuard solutions. The Company offers two editions of its QualysGuard Cloud Suite, the Enterprise edition for large and medium-sized enterprises and the Express edition for small and medium-sized businesses.

QualysGuard Vulnerability Management (QualysGuard VM), is a solution that automates network auditing and vulnerability management across an organization, including network discovery and mapping, asset management, vulnerability reporting, and remediation tracking. QualysGuard Policy Compliance (QualysGuard PC) allows customers to analyze and collect configuration and access control information from their networked devices and Web applications and automatically maps this information to internal policies and external regulations in order to document compliance.

QualysGuard PCI Compliance (QualysGuard PCI) provides organizations that store cardholder data a automated solution to verify and document compliance with PCI DSS. QualysGuard Web Application Scanning (QualysGuard WAS) uses the scalability of its cloud platform to allow customers to discover, catalog and scan a large number of Web applications. QualysGuard Malware Detection Service (QualysGuard MDS) provides organizations with the ability to scan identify and remove malware infections from their Websites. QualysGuard Web Application Firewall (QualysGuard WAF) delivers enterprise-grade Web application security without associated with appliance-based Web application firewall solutions. QualysGuard SECURE Seal helps organizations demonstrate to their online customers that they maintain a proactive security program.

Core Services include asset tagging and management, reporting and dashboards! , questio! nnaires and collaboration, remediation and workflow, big data correlation and analytics engine, and alerts and notifications. The Company�� infrastructure layer, which it refer to as its Infrastructure, includes the data, data processing capabilities, software and hardware infrastructure and infrastructure management capabilities that provide the foundation for its cloud platform and allow the Company to automatically scale its Infrastructure and Core Services to scan millions of Internet protocols (IPs).

The Company competes with Hewlett-Packard Company, Imperva, Inc., International Business Machines Corporation, McAfee, Inc., Symantec Corporation, Barracuda Networks, Inc., BeyondTrust Software, Inc., Lumension Security, Inc., nCircle Network Security, Inc., NetIQ Corporation, Rapid7 LLC, Tenable Network Security, Inc. and Trustwave Holdings, Inc.

Advisors' Opinion:- [By Jake L'Ecuyer]

Equities Trading UP

Qualys (NASDAQ: QLYS) shares shot up 8.24 percent to $20.68 after the company reported upbeat quarterly results.Shares of Office Depot (NYSE: ODP) got a boost, shooting up 15.95 percent to $4.84 after the company reported upbeat quarterly earnings and announced its plans to close at least 400 stores in the US.

- [By Jake L'Ecuyer]

Equities Trading UP

Qualys (NASDAQ: QLYS) shares shot up 10.23 percent to $21.07 after the company reported upbeat quarterly results.Shares of Office Depot (NYSE: ODP) got a boost, shooting up 15.95 percent to $4.84 after the company reported upbeat quarterly earnings and announced its plans to close at least 400 stores in the US.

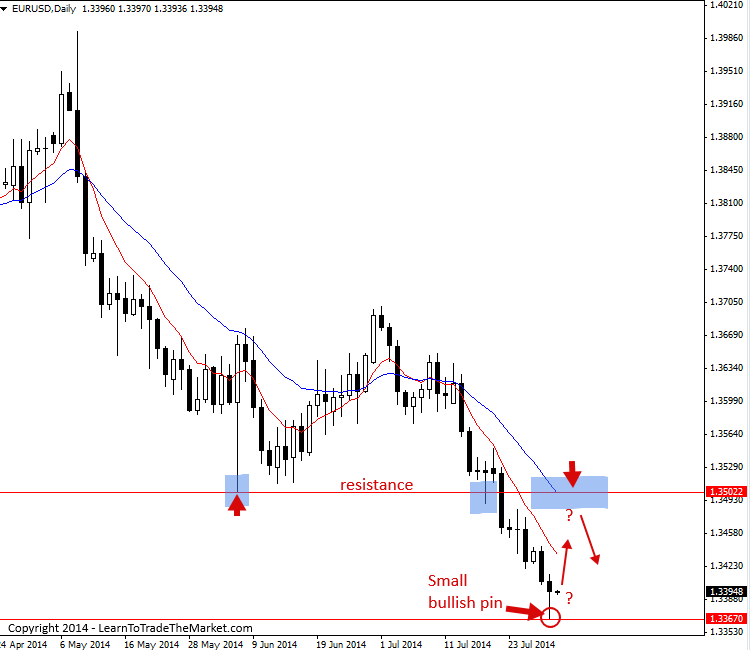

Copyright 2014 -- LeanToTradeTheMarket.com Follow @NialFuller This article represents the opinion of a contributor and not necessarily that of TheStreet or its editorial staff.

Copyright 2014 -- LeanToTradeTheMarket.com Follow @NialFuller This article represents the opinion of a contributor and not necessarily that of TheStreet or its editorial staff.